- Artemis Big Fundamentals in Crypto

- Posts

- Coinbase Q3’25 Spoiler Alert: Artemis Forecasts $1.67B Revenue, +48% YoY

Coinbase Q3’25 Spoiler Alert: Artemis Forecasts $1.67B Revenue, +48% YoY

Executive Summary

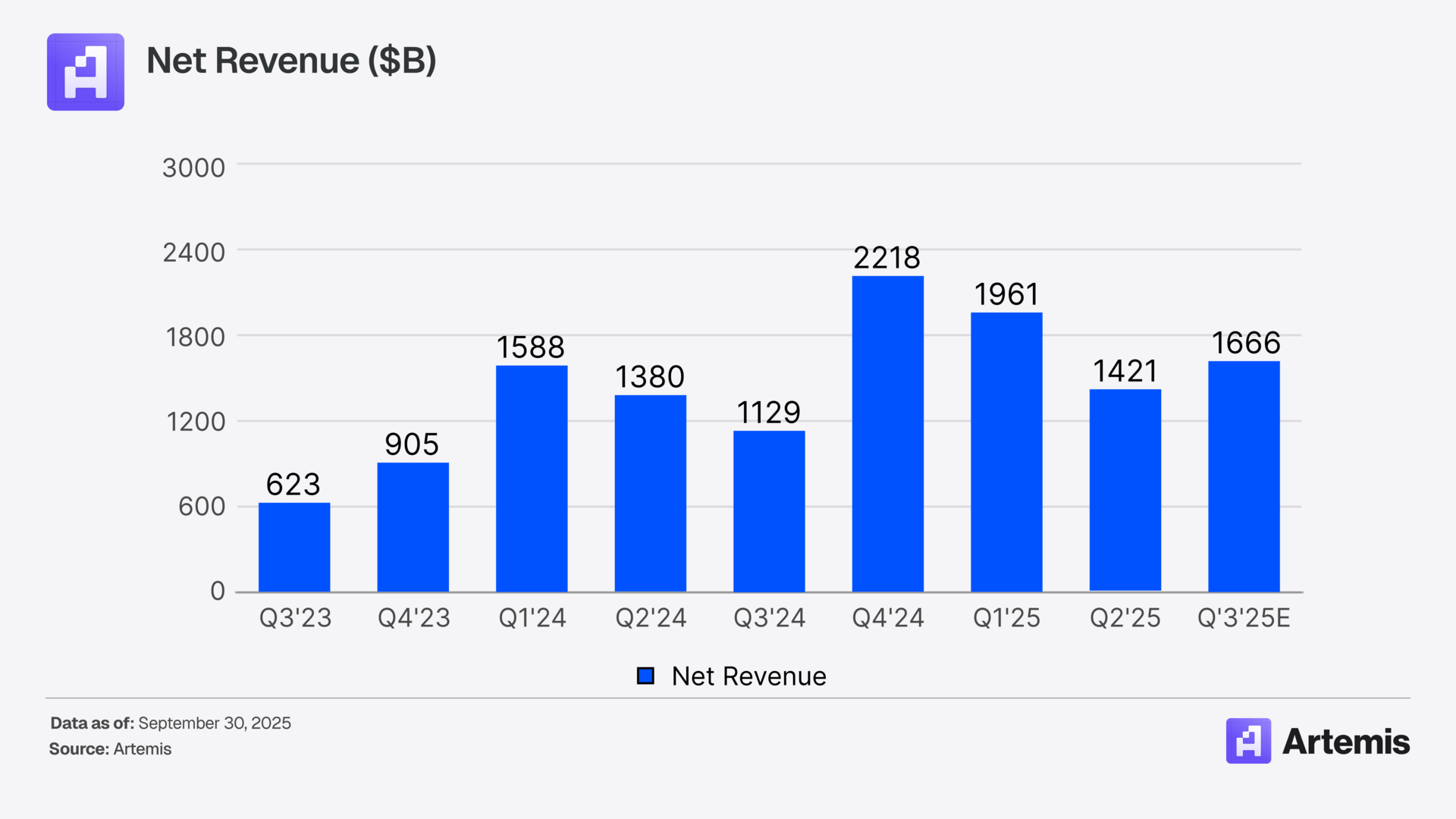

Real-Time Revenue Forecasting with Onchain/Offchain Data: Leveraging onchain and offchain data, Artemis estimates Coinbase’s Q3’25 revenue at $1.67 billion , compared to the Street’s estimate of approximately $1.79B-$1.81B (which would imply 50% YoY growth) . We think the street’s estimates are overly optimistic.

Trading Revenue Rebounds as Market Activity Recovers: Trading revenue remains Coinbase’s largest segment, estimated at $855 million, up 59% YoY growth.

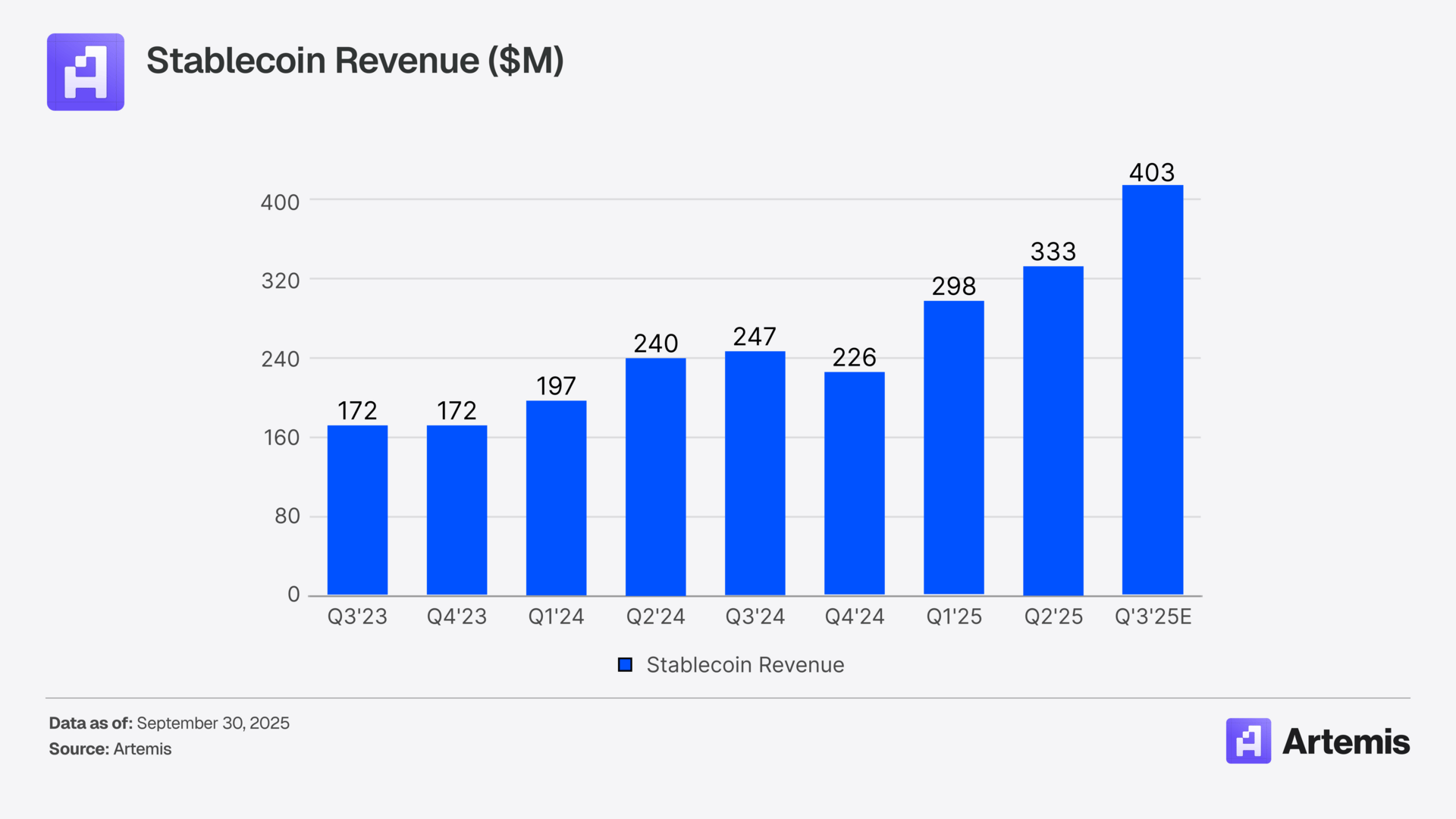

Stablecoin Revenue Continues to Drive Growth: With USDC’s supply rising 129% YoY to $74 billion, stablecoin-related revenue grew to an estimated $403 million, up 63% YoY growth solidifying its position as Coinbase’s second-largest revenue contributor after trading.

Layer 2, Staking, and Interest Income Provide Incremental Upside: Base, Coinbase’s Layer-2 network contributed approximately $56.5 million (+112% YoY), while blockchain rewards (primarily from ETH staking) added $133 million (-14% YoY). Interest income and subscription revenues generated $67 million (+4% YoY) and $147 million (+62% YoY), respectively, reflecting steady expansion in yield and platform engagement.

This report uses that transparency to forecast Coinbase’s Q3 results across its six primary revenue streams:

Trading Revenue

Base Revenue

Blockchain Reward Revenue

Stablecoin Revenue

Other Subscription & Service Revenue

Interest Revenue

Trading Revenue

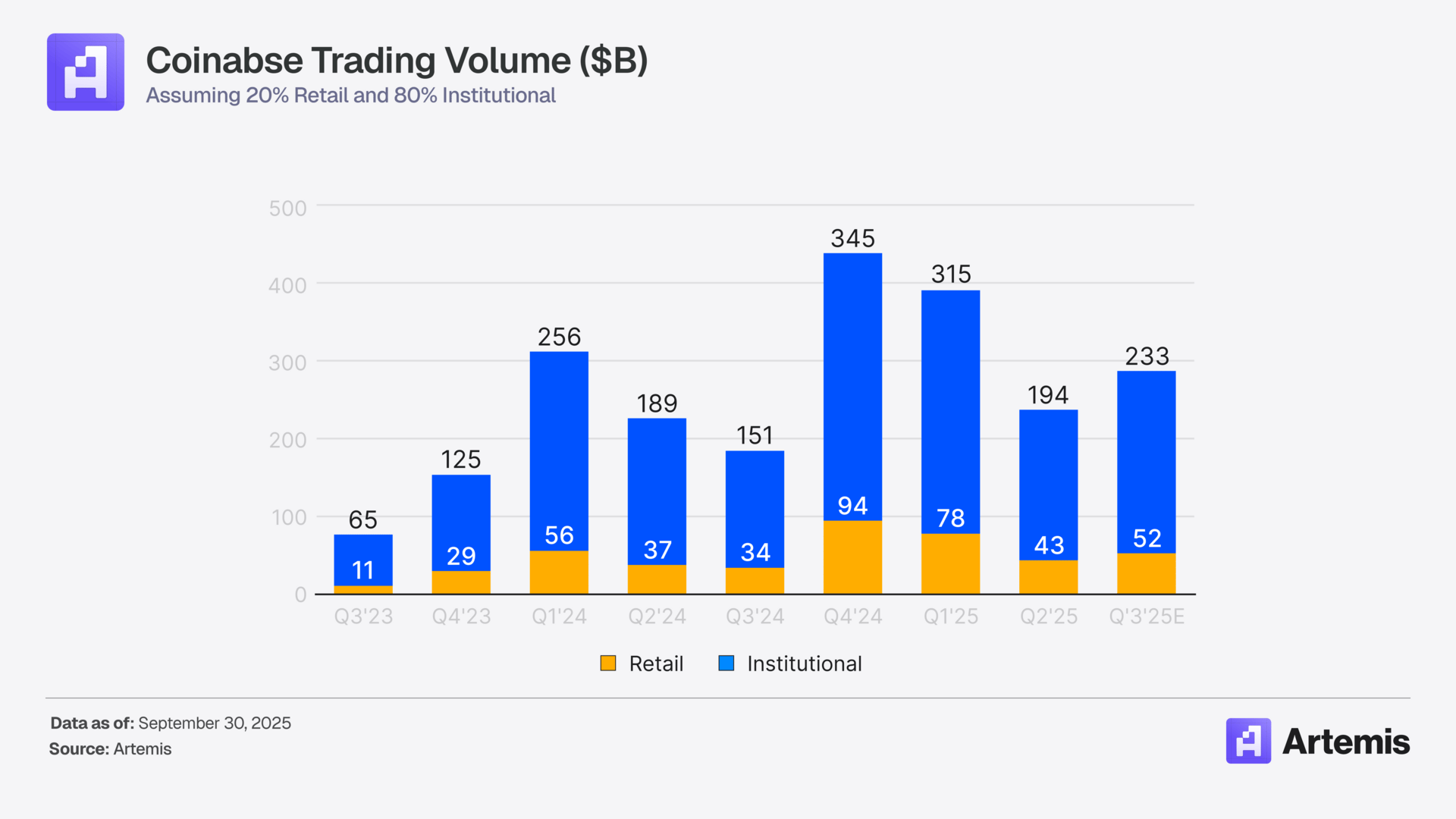

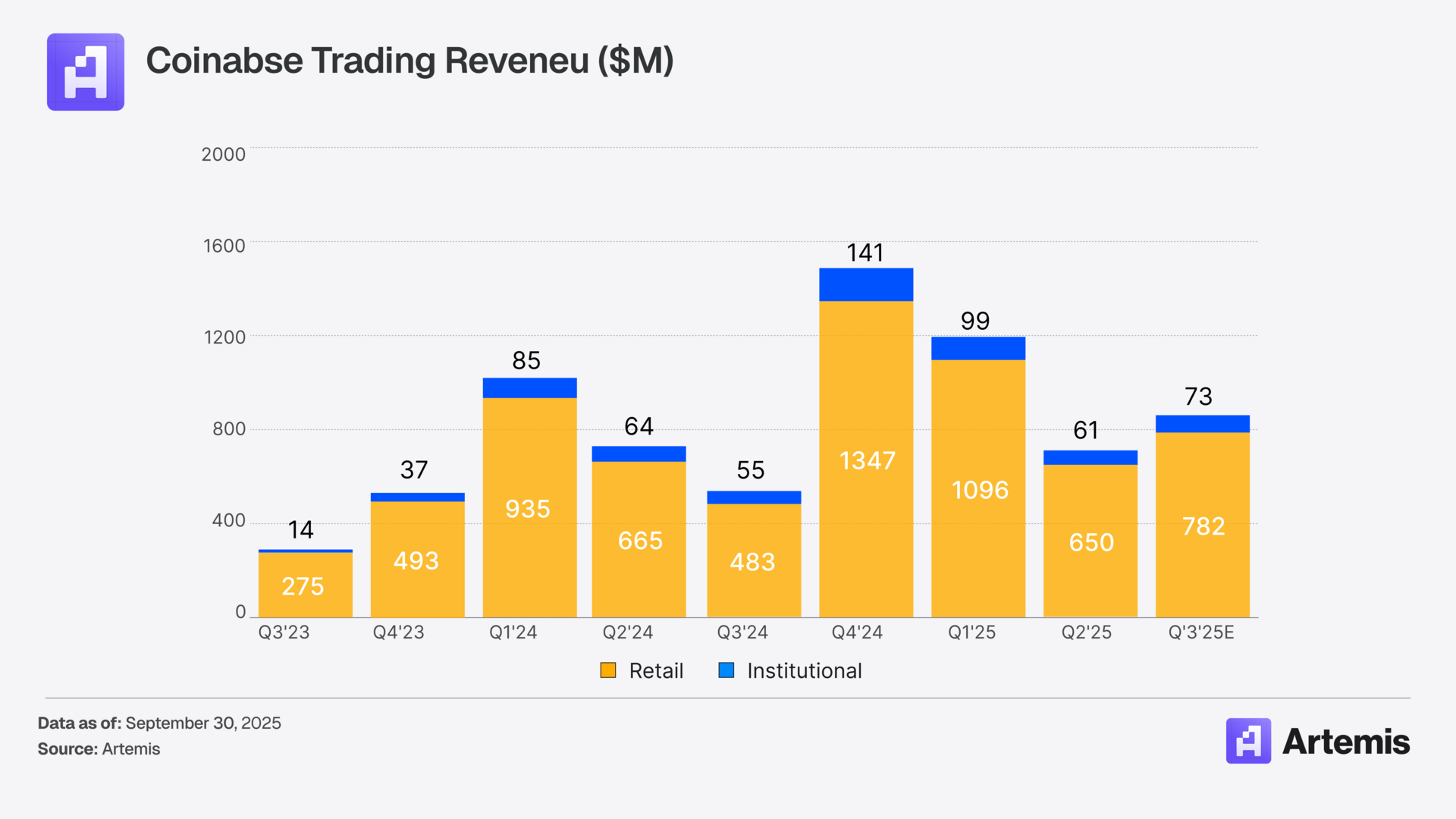

Coinbase’s trading activity is observable via tracking CEX trading volume, making it relatively straightforward to estimate trading-related revenue. Total spot trading volume rose 54 % YoY to $285 billion. Retail traders accounted for roughly 20 % of the total activity of $52B (+52% YoY), while institutional volumes expanded to $233B (+54% YoY)

Applying a 1.5% take rate to the retail segment, we estimate $782 million (+62% YoY) in retail revenue. For institutional clients, we assume 0.031% take rate, reflecting Coinbase’s derivative product offerings, yielding approximately $73 million (+33% YoY). Together, the total estimated trading revenue comes to $855 million(+59% YoY).

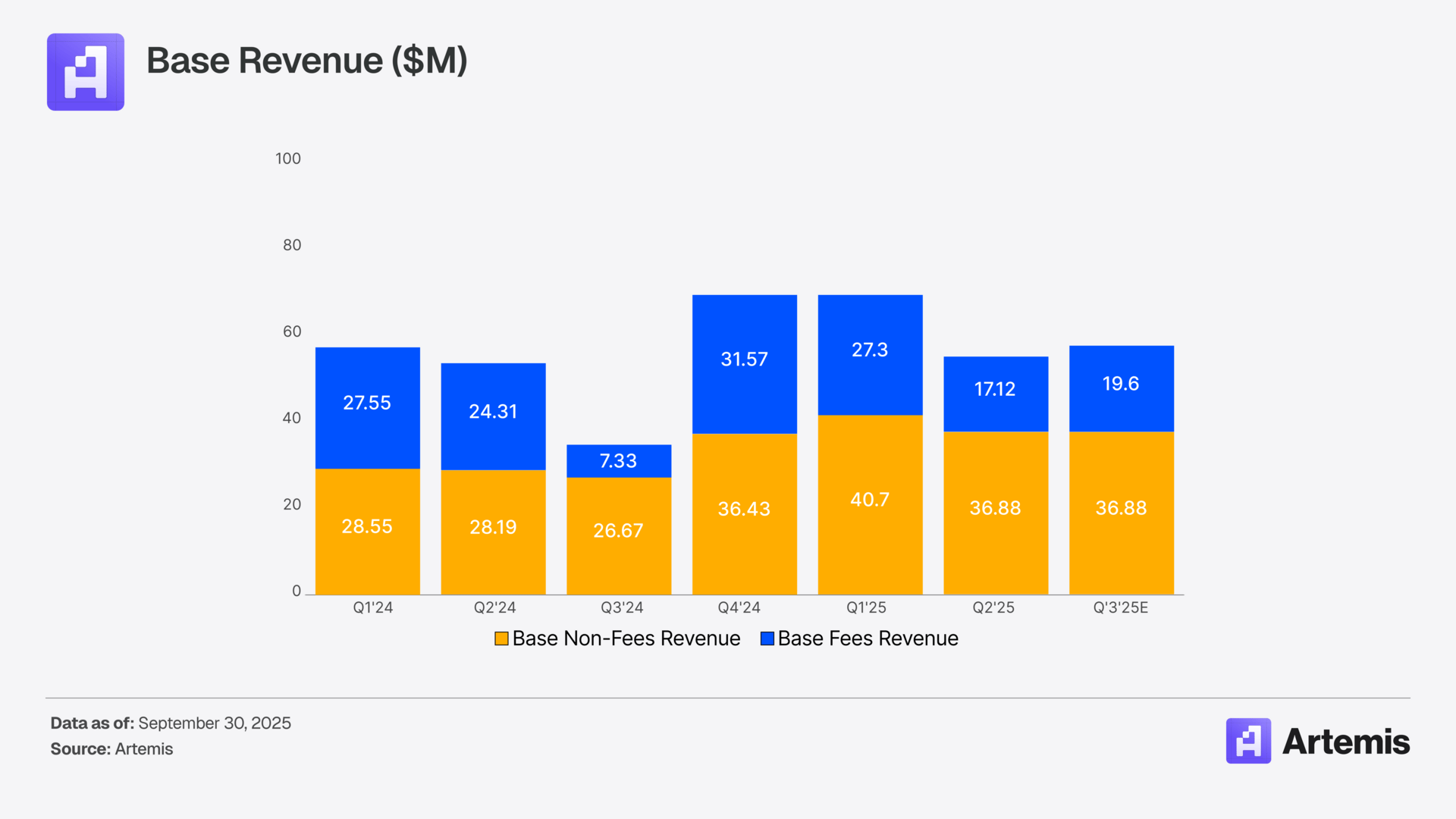

Base Revenue

Base, Coinbase’s Layer 2 network, earns revenue through transaction fees and likely additional non-fee revenue sources. Onchain data allows us to directly track fee income, which we estimate at $19.6 million (+167% YoY) for Q3. However, Base’s reported revenue has consistently exceeded onchain fee totals, suggesting income from B2B partnerships or infrastructure support. Assuming non-fee revenue remains flat at $36.8 million (based on recent quarters)(+38% YoY), total Base revenue for Q3 is estimated at $56.48 million(+112% YoY)

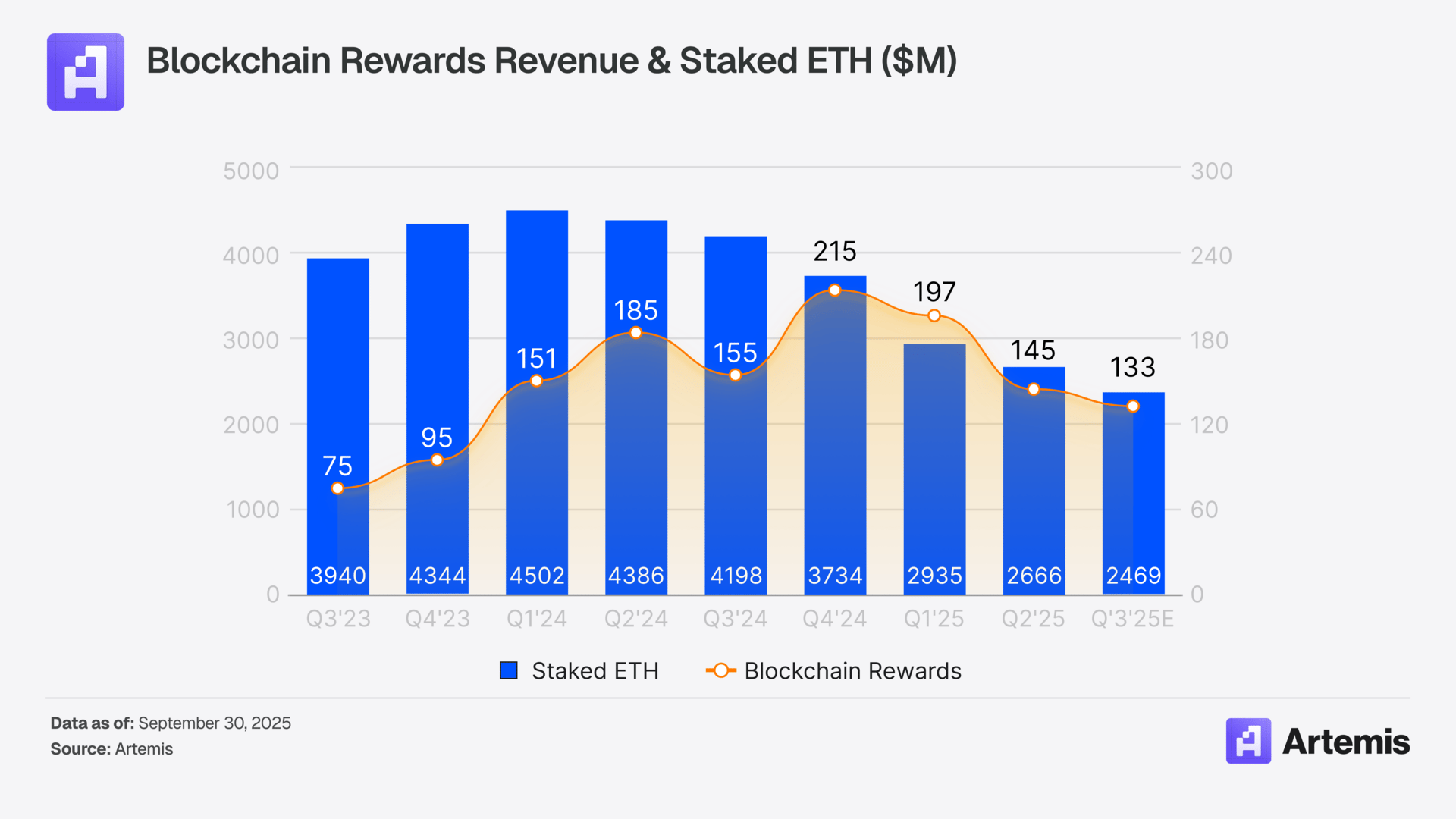

Blockchain Reward Revenue:

Coinbase provides staking services across several assets. For simplicity, we use staked ETH as a proxy to estimate blockchain reward revenue. Onchain data shows Coinbase’s staked ETH dropped from 2.66 M to 2.47million over Q3 (-41% YoY)

Based on this ETH range and average reward assumptions, we estimate $133 million (-14 % YoY)in blockchain reward revenue. While approximate, this method captures the directional trend of this revenue stream. Despite a modest quarter-over-quarter decline, staking continues to represent a resilient, high-margin line of business embedded within Coinbase One and institutional custody services.

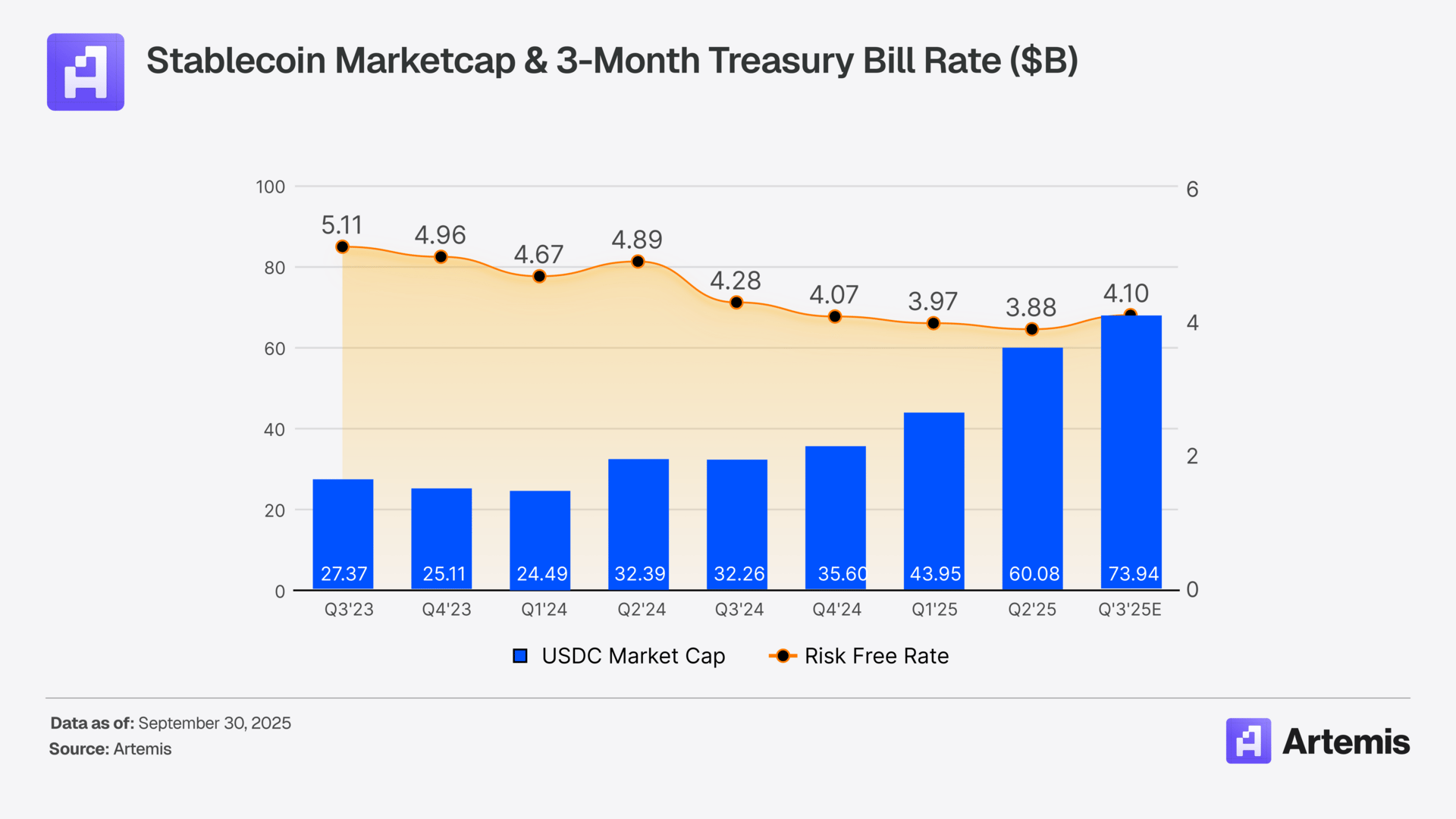

Stablecoin Revenue

The stablecoin business via USDC was a key growth driver in Q3. USDC’s market cap surged to $74 billion, a 129% increase YoY. To estimate yield on reserves, we use the 3 Month Treasury Bill Rate, which was in the range from 4.25% to 3.92. We calculate the stablecoin revenue by averaging the rate and USDC supply for this quarter.

Coinbase’s share of total USDC revenue has fluctuated between 62% and 72% in recent quarters. Using the median of 68% as a baseline, we estimate $403 million (63% YoY) in stablecoin-related revenue for Q3.

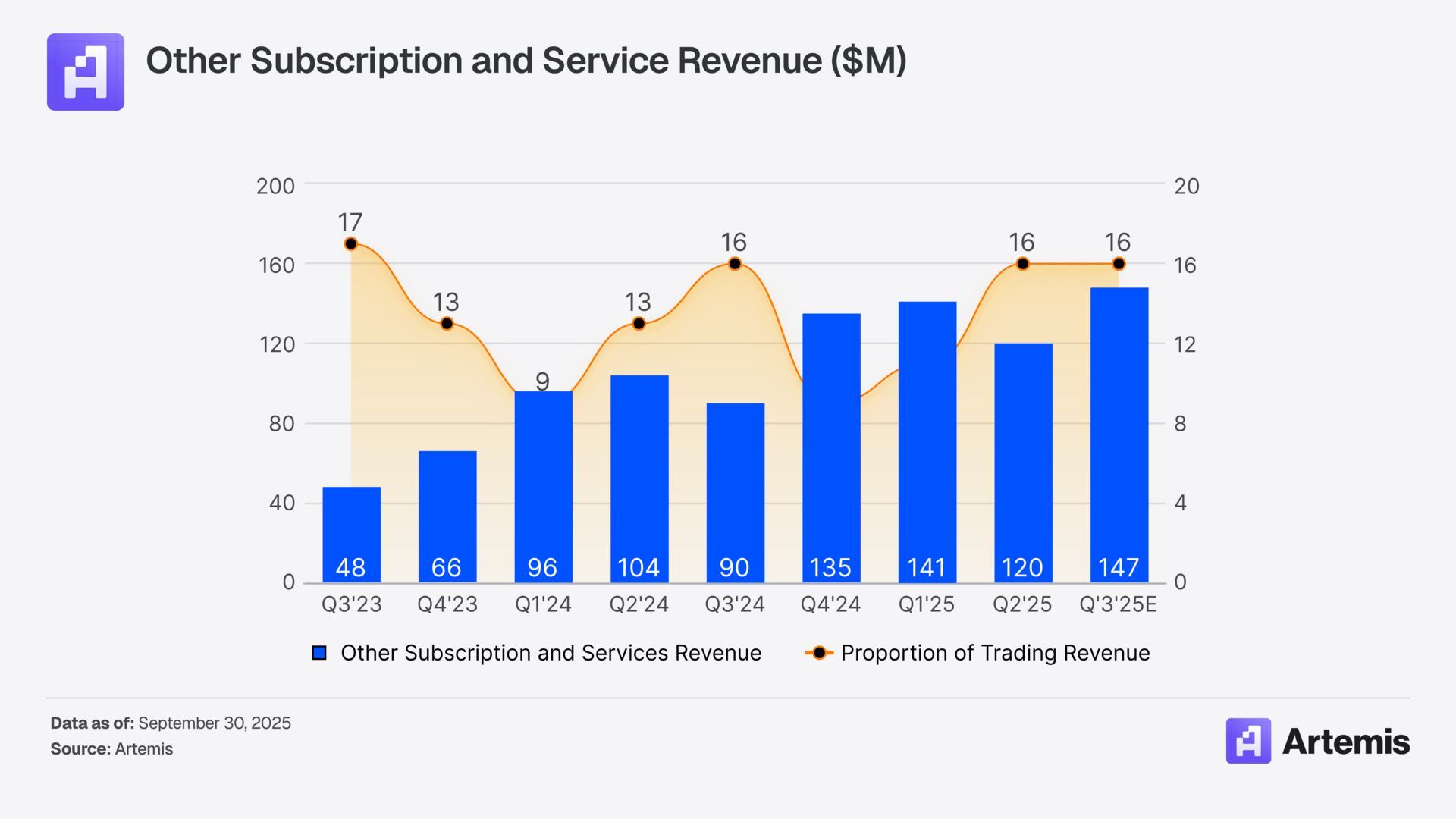

Other Subscription & Service Revenue:

This segment includes revenue from Coinbase One (its premium subscription product) and custody fees, particularly for ETF clients. We view this revenue as a function of total trading activity. Applying a 16% multiplier to trading revenue, we estimate $147 million for Q3, marking a 62% increase YoY

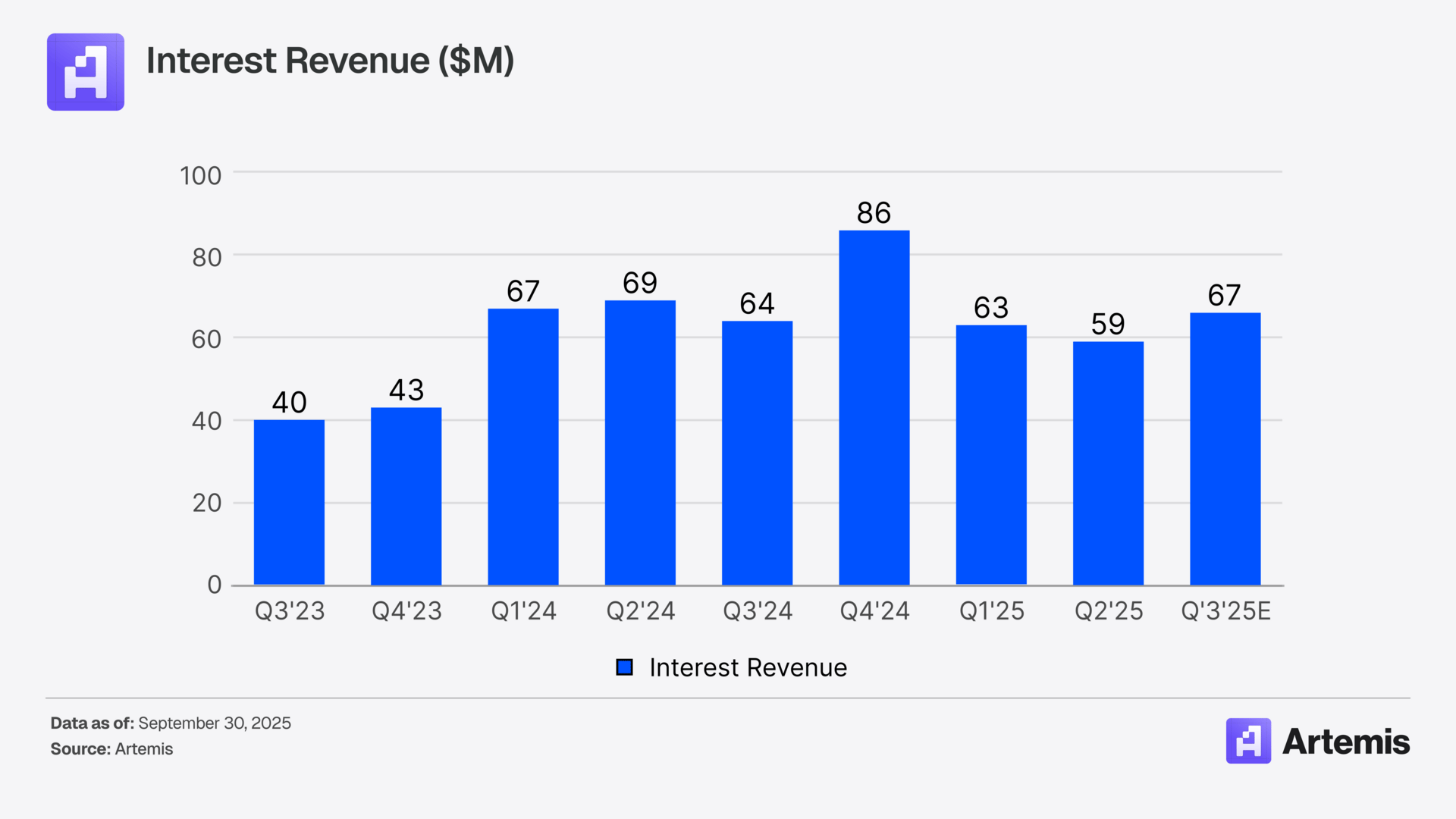

Interest Revenue:

Lastly, Coinbase earns interest on its cash and treasury holdings. Using the same 3-month Average Treasury Bill Rate as a benchmark, we estimate $67 million in interest income for Q3 (+4% YoY)

Net Revenue:

Based on our estimates for Q3, Coinbase Net Revenue is projected to be $1,67B which is a 48% YoY increase.