- Artemis Big Fundamentals in Crypto

- Posts

- Protocol Highlight: Pendle

Protocol Highlight: Pendle

,

Welcome to the protocol highlight of the month.

At Artemis, we aim to bring light to crypto and highlight real businesses in crypto.®

Today, we interview TN Lee, Founder of Pendle. Pendle has emerged as one of DeFi’s fastest-growing fixed yield and yield trading protocols, with TVL surpassing billions and stablecoins now making up more than 80% of its liquidity. By splitting assets into Principal Tokens (PTs) and Yield Tokens (YTs), Pendle has created a marketplace that serves both risk-averse investors seeking predictable returns and risk-tolerant traders chasing points and upside.

Read more to learn about Pendle’s story. The opportunity ahead and how Pendle is on its way to capture a share of the $140T global fixed income market.

1. Hi TN! Pendle was founded in 2020. What is the Pendle story? Why did you start Pendle?

The idea of Pendle came about during DeFi Summer in 2020. Back then when food farms were at the height, 5-digit or even 6-digit yields were the norm. The problem with them was that they would never last more than a few days and sometimes, a few hours. That got us thinking: what if there were a way to lock in those yields? And that’s when we decided crypto needed a protocol to make DeFi fixed yield a reality. The concept made even more sense when you realized how the global fixed income market is actually the largest securities market in the world.

2. I remember Pendle originally as a way to farm Eigenlayer and Ethena last year. What is Pendle and how do customers use Pendle?

Pendle is a yield trading protocol. In a nutshell, we enable users to trade the “yield” of an asset. In this case, yields include any receivables that an asset generates, be it normal yields or points. We enable this by splitting the yield and points that an asset generates into a separate asset, called Yield Tokens or YT in short. The remaining asset is the principal, and it is represented by Principal Tokens or PT in short.

If you are bullish on the yields and points that an asset generates, buy the YTs. If your bet is correct, and the yields and points that the YT generated is worth more than what you paid for, you profit.

For those who are seeking stable yields, you can purchase PTs for a fixed APY instead, in other words, buying an asset at a discounted rate that allows you to profit from the price discrepancy.

Beyond the yields, Pendle offers you the possibility to participate in any popular DeFi protocols listed, with the investment thesis that suits your risk management the best.

3. What is Pendle’s business model? Why do tokenholders onto $PENDLE?

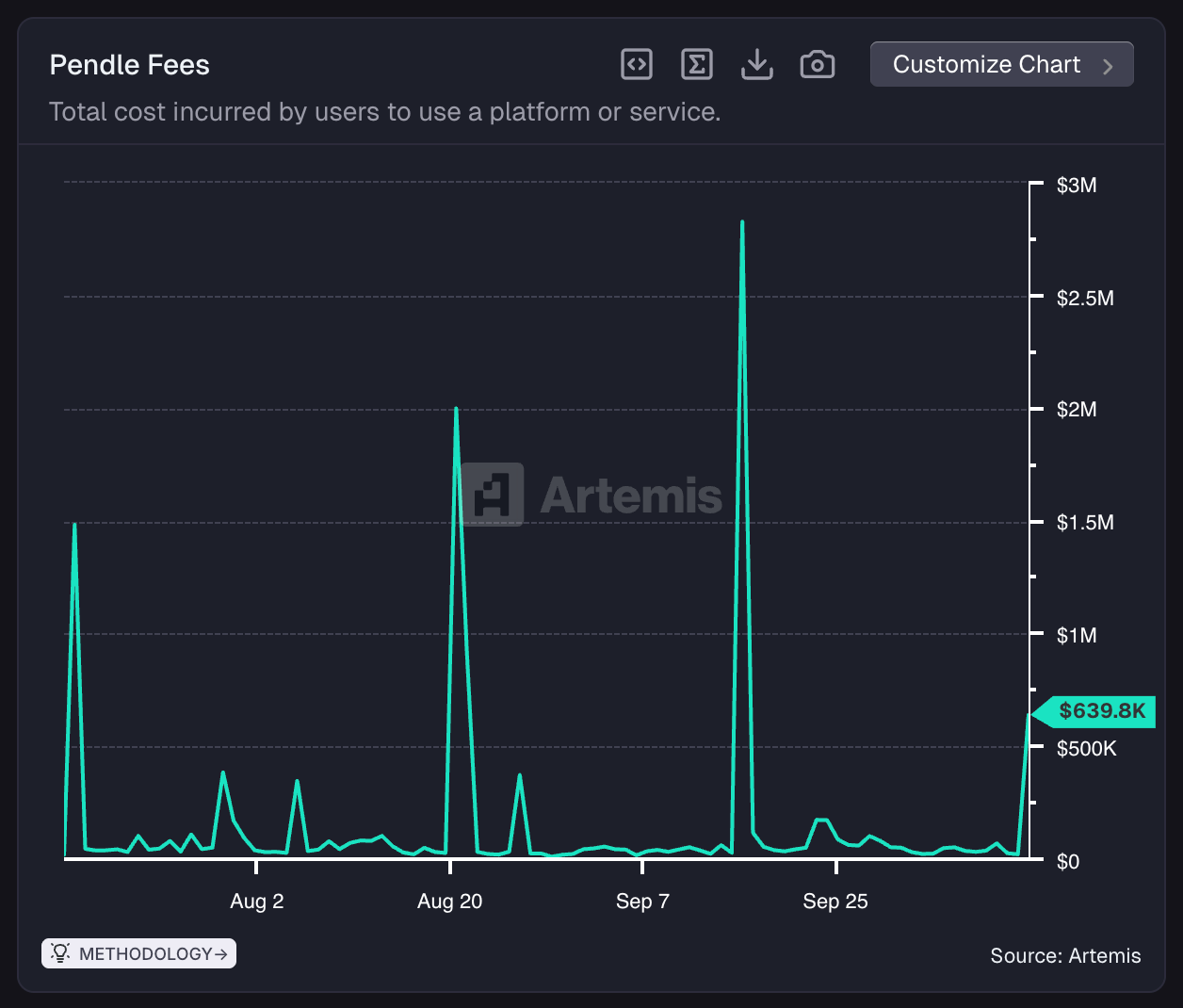

Pendle earns fees from 2 main sources, swap fee and yield fee. In short, the more trading volume and TVL we have, the more revenue we generate. Part of this yield fee also consists of points or airdrops, all of which are distributed back to vePENDLE holders.

4. What is the biggest misconception of Pendle today?

I’d say it’s the perception that getting listed on Pendle is difficult. It’s actually pretty simple to get listed on Pendle, especially now that we have a process established for community driven pool deployment. This is one of the main reasons why there are so many new markets being launched on Pendle these days, particularly yield-bearing stablecoin projects such as Gaib, USDai, and more.

If you are a DeFi project that generates any form of yield / points, it’s really straightforward to get your asset listed on Pendle.

5. James Ho at Modular Capital and Jose Sanchez at Spartan Group highlight Pendle as a core winner of stablecoins. How did stablecoins become 78% of Pendle’s TVL and what do you think of the stablecoin opportunity ahead for Pendle?

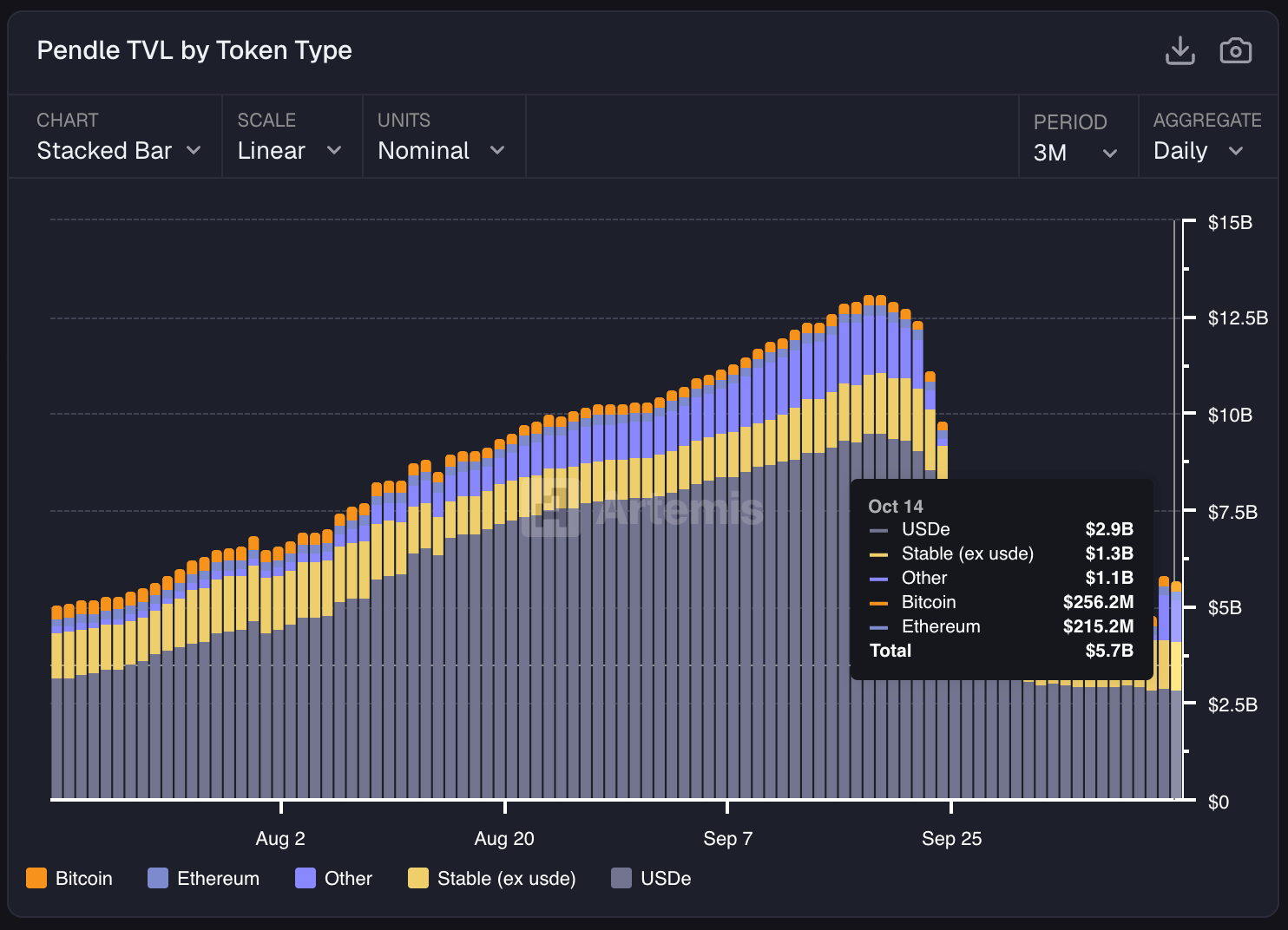

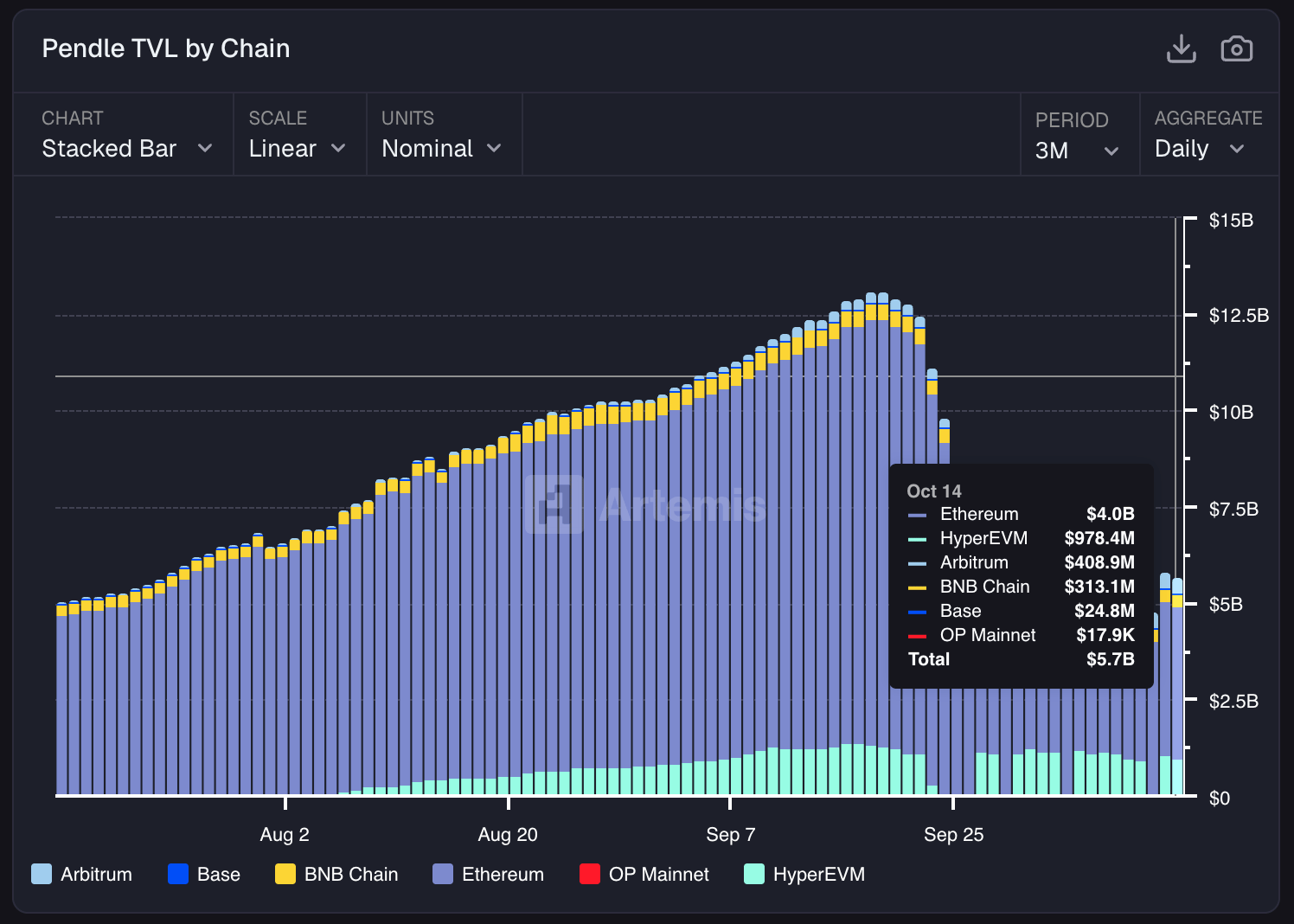

I would like to attribute that success to the fact that Stablecoins are the major driving narrative at the moment. Looking back, when Eigenlayer and restaking were the dominant narratives, the majority of our TVL consisted of staking related assets, which were mostly ETH denominated. After that we saw BTCFi rose as a strong narrative, led by Babylon and its derivatives. Naturally, our TVL followed suit and we had a significant portion of our TVL in BTC assets.

And now that stablecoins are the main narrative at the moment, we’re seeing the same phenomena happening to our TVL. One of Pendle’s greatest strengths lies in how our design and infrastructure allow us to adapt quickly to pretty much any narrative and trend. As long as there’s yield, the asset can be “Pendled”.

6. What are the metrics that matter for Pendle and how much do fundamentals matter when talking to investors and liquid token funds?

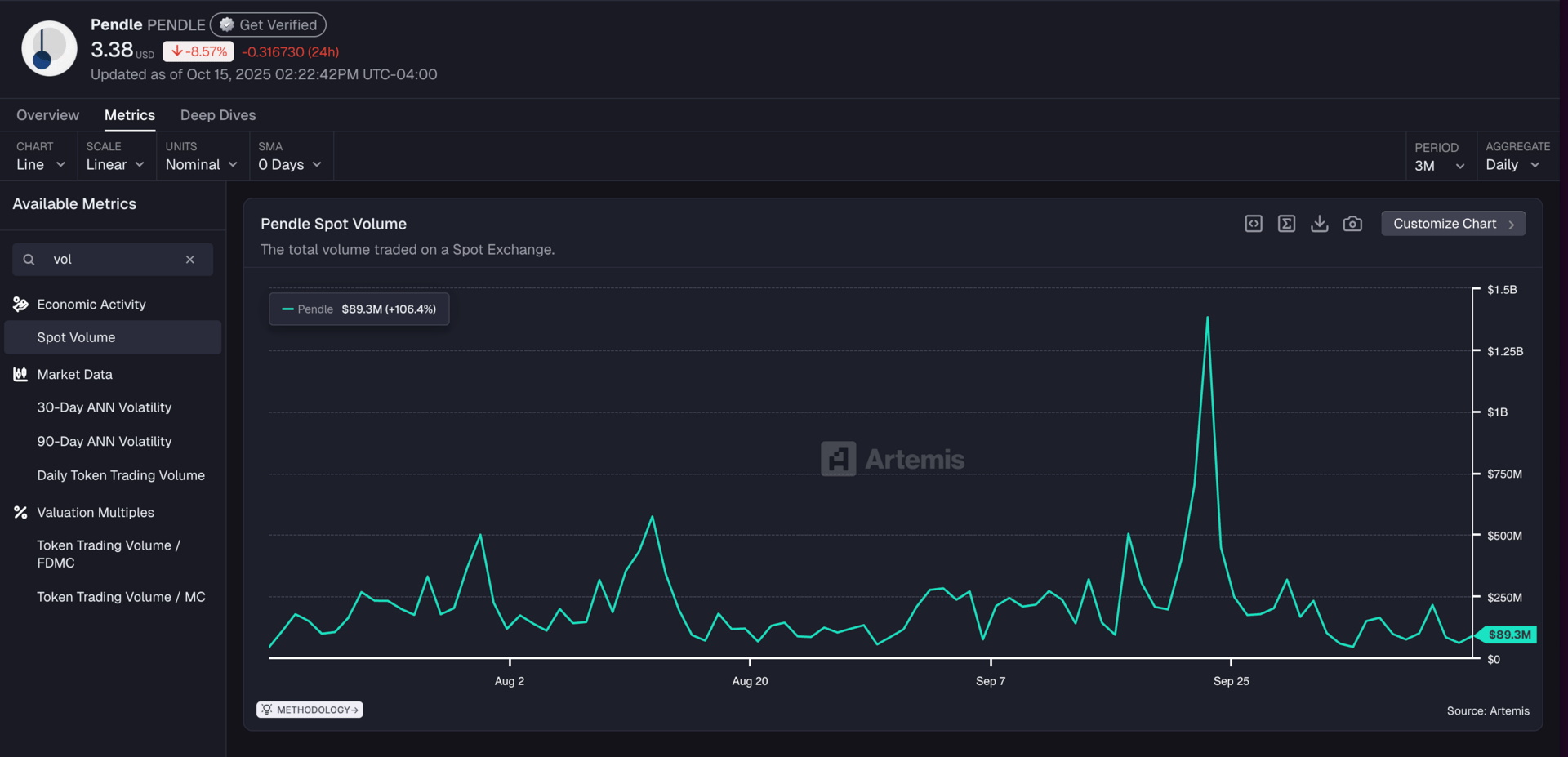

TVL and Volume are the key metrics here as they directly contribute to our revenue, and they are definitely one of the key factors when it comes to talking to investors and liquid funds. Narratives evolve constantly in different cycles, but these fundamentals remain the core metrics to evaluate our performance in the long run.

Trust is very important when it comes to large investors and liquid funds, and these metrics signify trust towards the protocol. The longer we can sustain and grow the metrics, the more trust is quantified into the protocol.

7. How do you think about the roadmap moving forward for Pendle?

We have three goals for this year.

The first is Boros, our new yield trading platform with margin. At its core, Boros is built to handle all kinds of yields. Not just from DeFi, but also from off-chain and traditional finance like mortgage rates. At start, we're focusing on something more immediate and familiar to the space: trading perpetual funding rates. After just 2 months of launch, Boros is already showing great traction and promise. Its volume is growing 10x faster than V2 and has already accrued over $1.8B notional trading volume. Even at this pace, we’ve only captured about ~0.03% of the TAM so the growth potential is huge even when we’re only looking at perpetual funding rates.

Second one is Citadels, which is all about improving the distribution of Pendle PTs and building its own economic system, especially after crossing the ATH of $2bn of PT in lending markets lately. Right now, fixed yields through PTs are mostly available within EVM ecosystems. With Citadels, we’re looking to expand that reach, in particular to groups like institutional investors who require KYC, Shariah-compliant funds, and even non-EVM chains like HYPE, TON, and Solana. All of these are different “Citadels” for us to build towards. It’s a big step for Pendle in making fixed yields more accessible across the board.

Last but not least, we are moving forward to make Pendle V2 permissionless as we step into a new phase of growth. As mentioned earlier, listing your asset on Pendle has become easier than ever.

8. What can go right for Pendle as we think long term to 2030 and beyond?

Our vision for Pendle is pretty ambitious. We want all yields to become tradeable on Pendle, not just DeFi ones, but across all types of yield globally. The idea is to build a yield market that can serve as the go-to venue for best-in-class yields, whether they come from DeFi, CeFi, or even TradFi.

We truly believe that the most impactful blockchain applications are the ones that solve real-world problems more effectively than their traditional finance counterparts. That’s the bar we’ve set for Pendle.

When you look at the numbers, the opportunity is massive. The global fixed income market is valued at around $140 trillion. It’s the largest securities market in the world. The demand for fixed yield products isn’t just hypothetical, it’s already well-established. But what’s missing is a unified platform that can deliver every type of yield, onchain or offchain, seamlessly. That’s the gap we see Pendle filling.

9. What are the biggest risks and challenges to Pendle’s future success?

Right now, the biggest challenge we’re facing is breaking out of the “on-chain mold.” Pendle has found a solid product-market fit within the crypto-native ecosystem, but if we really want to scale and become a global yield layer, we need to build the infrastructure to take Pendle products beyond the boundaries of Web3.

That means establishing the right rails to package and offer these products in a way that makes sense outside of crypto. And with that comes a whole new set of considerations - regulatory compliance, KYC, legal structuring, custodianship…. All of these are important foundations in enabling real-world adoption and unlocking access institutions, funds and clients outside the crypto bubble.

We're already in active discussions with several potential partners who can help us navigate these hurdles. We're also collaborating closely with the Ethena team to explore concrete pathways for bridging our collective infrastructure into the broader financial world. It’s a complex challenge, but also one of the most exciting frontiers for us. If we can get this right, it opens the door to something much bigger than just DeFi.

10. Why is a financial product like Pendle’s necessary in DeFi?

Before Pendle, there really wasn’t a reliable way for users to access fixed yield exposure in DeFi. And that was a huge gap. Fixed income is a core part of any mature financial system - it’s how investors preserve and grow wealth with more predictability. It’s also the kind of product that naturally attracts a different class of users: sophisticated investors who have a much more nuanced view of risk, compared to your typical DeFi degens chasing high APRs.

We’ve seen this play out firsthand. A large portion of PT volume comes from 8- and 9-figure whales who are locking in fixed yields, despite the potential upside of future yield and airdrops. The reliability and predictability of fixed yield are hard to beat from a risk/reward perspective.

As a yield market, Pendle facilitates real price discovery for yield curves in crypto. It helps establish a term structure of interest rates, which is an important signal for the broader DeFi financial market, similar to what government bonds do in TradFi.

On top of that, with the rise of points and airdrop farming, Pendle has evolved into more than just a yield venue. It's also become a kind of democratized “seed investment” platform, where retail users can gain early exposure to emerging protocols in a way that was previously only accessible to insiders or VCs. That’s a pretty compelling layer of utility, and it aligns well with our goal of making yield markets more open and inclusive.

11. What did Pendle do differently from previous protocols that attempted to build something similar?

I think one of the biggest differentiators for us is our ability to identify and adapt to emerging narratives and market trends. If you look at Pendle’s TVL composition over time, you’ll notice some pretty significant shifts. Early on, our liquidity was heavily concentrated in ETH, especially during our early LST and LRT days. Then, as BTCfi started gaining traction, we saw a natural pivot, and our liquidity composition also followed suit.

Today, more than 78% of our TVL is in stablecoins. And in my view, that’s actually a very healthy sign. Unlike more speculative assets, stablecoin yield tends to have consistent demand across market cycles. Whether it’s a bull or bear market, there’s always an appetite for stable, predictable returns, especially from users focused on wealth preservation.

This agility to move with the market is something we pride ourselves on. It’s what’s allowed us to stay relevant and continue growing, regardless of what narrative is in play.

12. What is the persona of the typical Pendle user?

As cliché as it might sound, there’s something in Pendle for every type of user.

If you’re someone who prefers conservative, reliable returns, PTs offer fixed yield which is perfect for wealth preservation and planning.

If you’re more risk-tolerant and want to make leveraged plays on protocols you believe in, especially to maximize airdrop potential or future yield, YTs are the play.

And if you’re somewhere in between or just want a bit of both, providing liquidity as an LP gives you balanced exposure to both fixed yield and the potential upside from yield and points.

Pendle Deep Dive Data

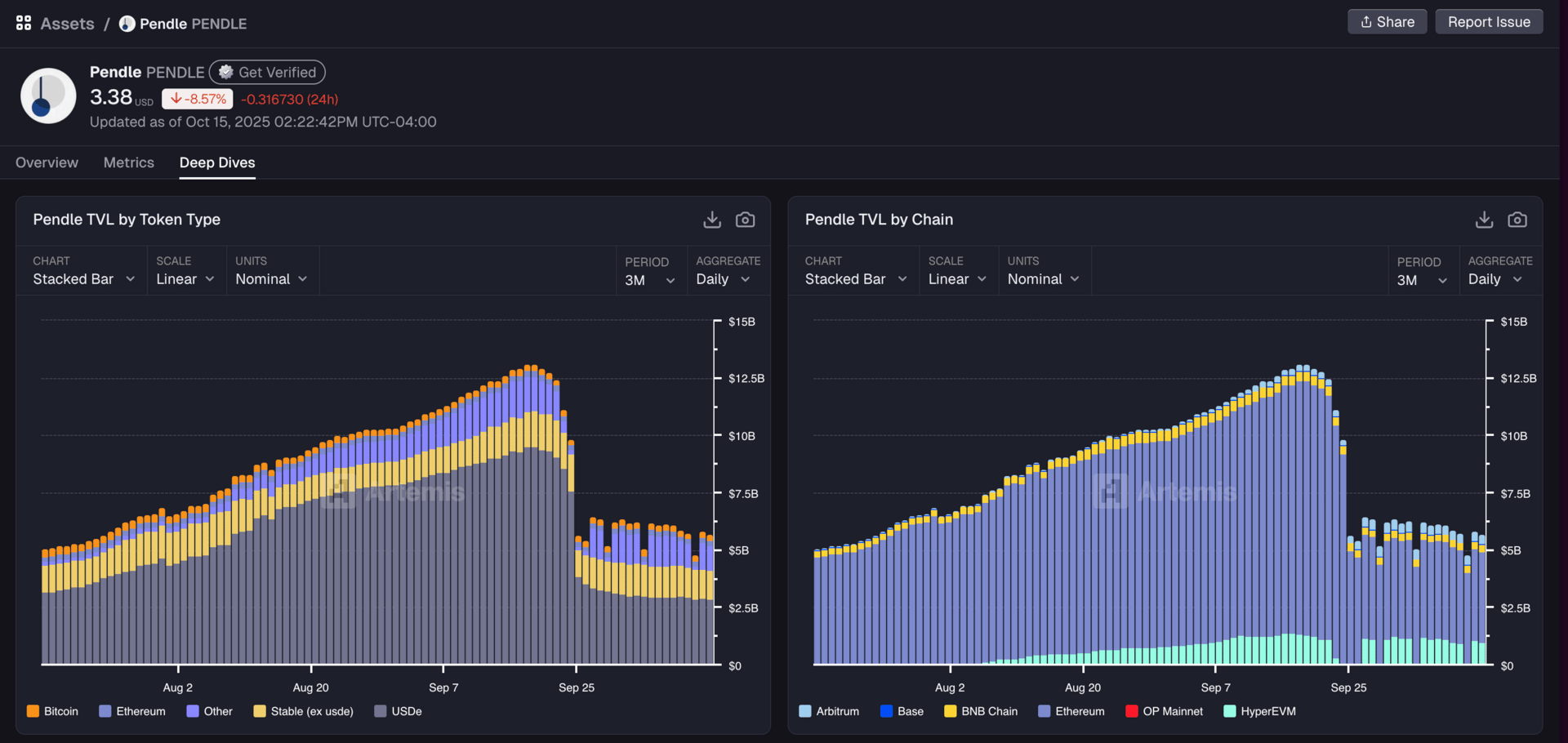

Pendle’s TVL peaked above $13B in September 2025, with the majority coming from USDe (~$8B), followed by other stables, BTC, and ETH.

Pendle’s liquidity mix is highly narrative-driven. Initially ETH-heavy (LST/LRT days), it pivoted to BTCFi, and now 78%+ is in stablecoins. This shows huge demand for predictable, sustainable yield. The spike and correction in Sept ’25 reflects a large maturity cycle unwind.

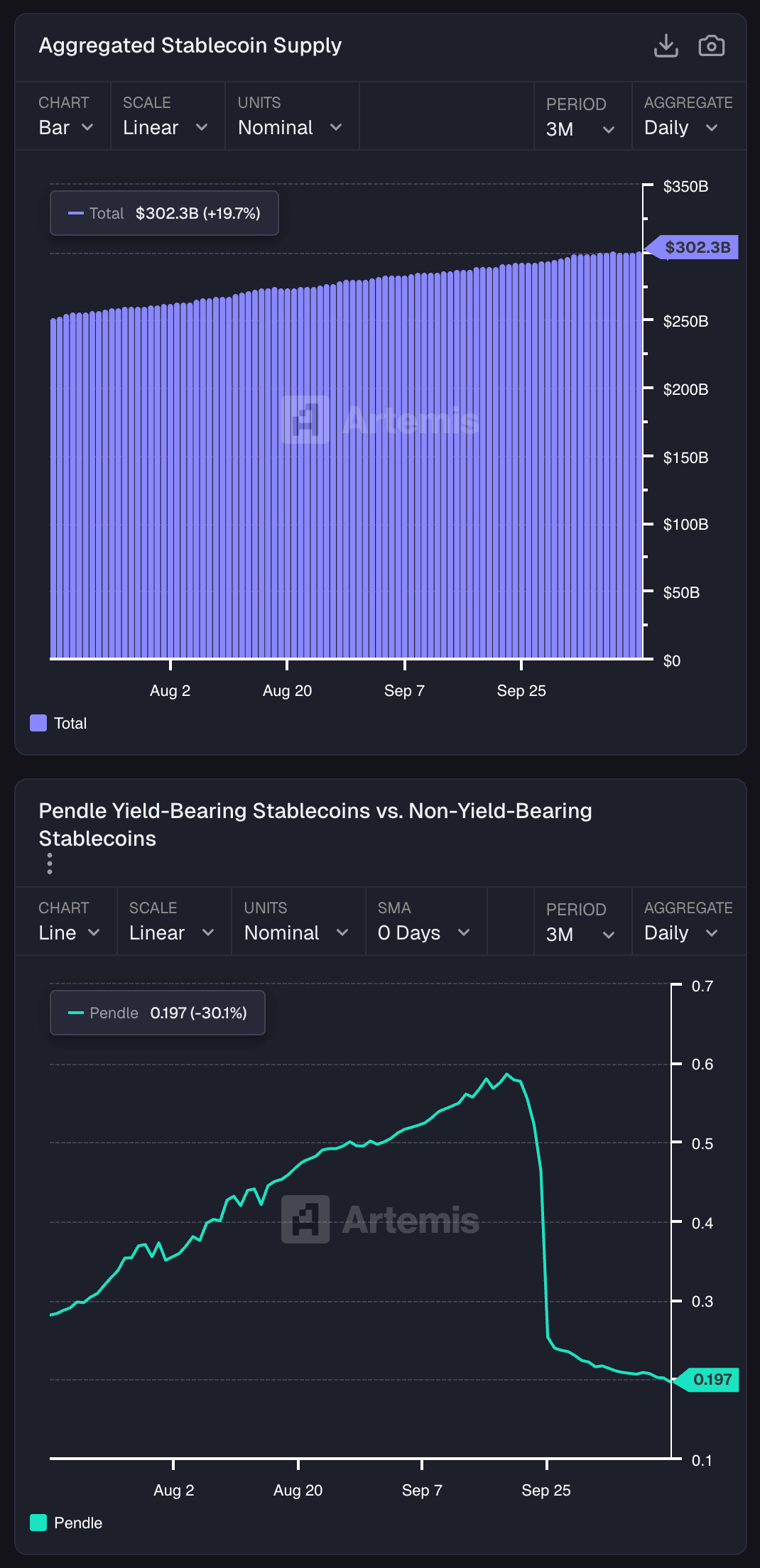

Stablecoins are at the heart of Pendle’s growth story. With aggregate supply climbing to over $300B and a rapidly rising share of yield-bearing stablecoins, Pendle has positioned itself as the key venue to tokenize and trade this yield. By capturing the shift from passive stablecoin holding to active, yield-generating formats, Pendle is tapping into one of the largest and most consistent liquidity bases in crypto. This make stablecoins the backbone of its long-term TVL and revenue expansion.

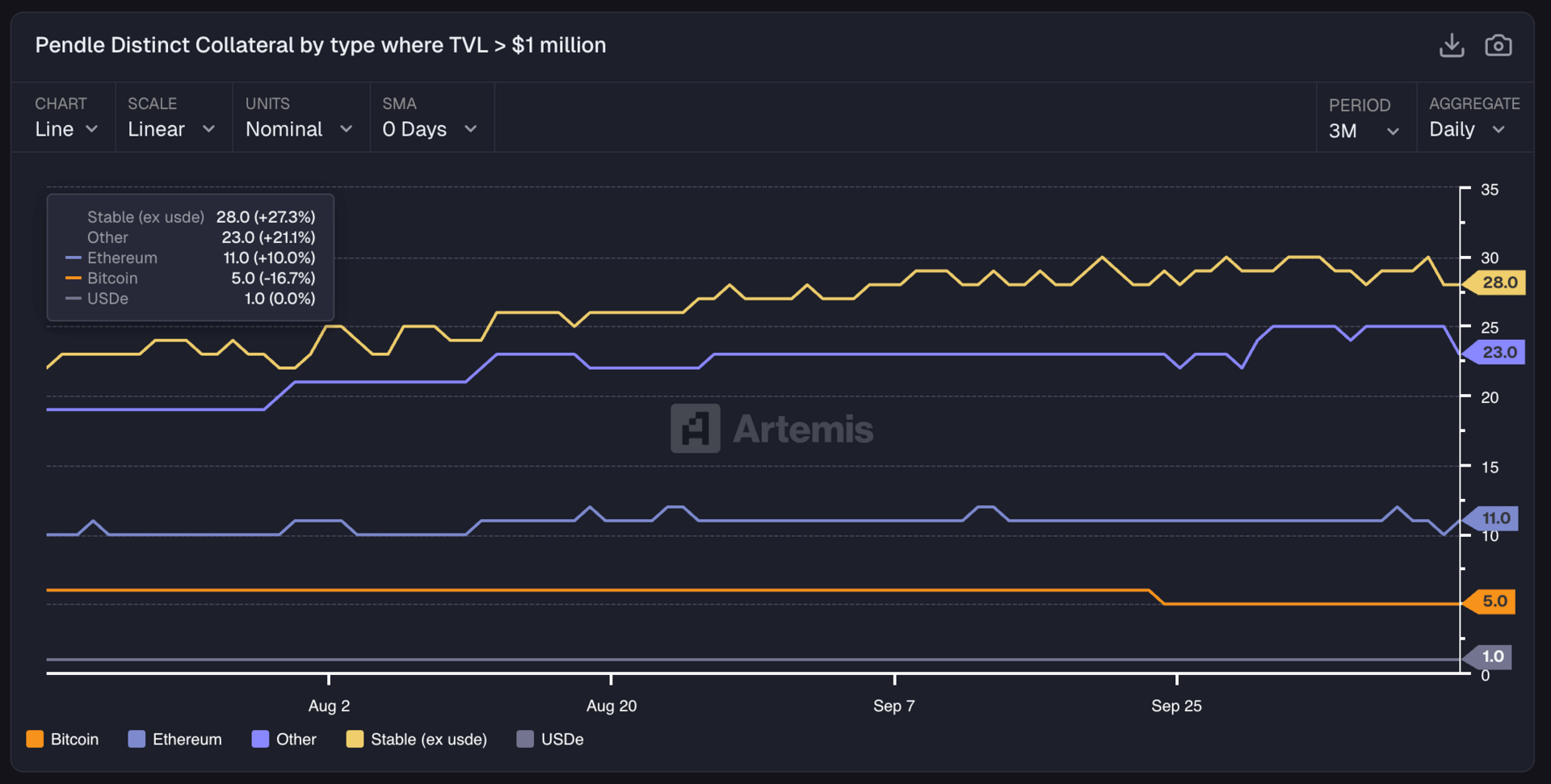

Pendle’s collateral base has expanded meaningfully, with stablecoins leading the way at 28 distinct collateral types (+27%), reflecting their role as the backbone of the protocol’s growth. While Ethereum (11 types, +10%) and other assets (23 types, +21%) continue to provide diversification. This diversification shows Pendle evolving into a multi-asset yield marketplace that can flexibly capture new narratives while being anchored by the stability of stables.

Check out our deep dives here:

Artemis Disclaimer: The authors, affiliates, or stakeholders of Artemis may hold interests in the tokens or protocols mentioned in this content. This disclosure highlights potential conflicts of interest and is not an endorsement to buy or invest in any specific token or protocol. The content is for educational and informational purposes only and should not be construed as investment advice in any form.

Readers should approach this information cautiously and consider their unique circumstances before making investment decisions. The views and opinions expressed are subject to change without notice, and Artemis bears no liability for any loss or damage arising from the use of this information.